The Role of Big Data in Personalized Health Insurance Plans

The Role of Big Data in Personalized Health Insurance Plans is becoming increasingly vital as the healthcare landscape evolves. By leveraging vast amounts of data, insurance companies can create tailored plans that cater to individual needs, preferences, and medical histories. This article delves into how big data is transforming health insurance, the benefits it offers, its challenges, and its future implications.

1. Understanding Big Data in Health Insurance

Big data refers to the immense volume of structured and unstructured data generated every day. In the context of health insurance, this data encompasses a wide array of information, such as patient records, claim histories, demographic details, lifestyle choices, and even social media activity. The sheer volume and variety of this information present both opportunities and challenges for insurance providers.

Key Components of Big Data in Health Insurance

- Volume: Insurers collect massive amounts of data from various sources, including hospitals, clinics, wearable devices, and online platforms.

- Variety: The different types of data include numeric, text, images, and videos, requiring sophisticated tools for analysis.

- Velocity: Data is generated at an unprecedented speed, demanding real-time analysis to derive useful insights.

- Veracity: Ensuring data accuracy and reliability is crucial for effective decision-making.

- Value: Extracting meaningful insights from data allows insurers to improve service delivery and customer satisfaction.

Incorporating big data enables health insurance companies to not only assess risk more accurately but also design personalized products that meet the specific needs of their policyholders. Through predictive analytics, insurers can identify potential health risks and implement preventive measures, ultimately leading to better health outcomes and reduced costs.

2. Benefits of Personalized Health Insurance Plans

Personalized health insurance plans represent a significant shift from traditional one-size-fits-all models. This customization offers numerous advantages for both insurers and consumers.

Advantages for Consumers

- Tailored Coverage: Policies can be designed to meet individual health needs, ensuring that consumers pay for coverage relevant to them.

- Cost Efficiency: By offering personalized plans, insurers can help consumers avoid unnecessary expenses on services or treatments they do not require.

- Proactive Health Management: With access to data-driven insights, consumers can engage in healthier behaviors and preventative care.

- Improved Customer Experience: Personalized communication and outreach efforts enhance the overall experience, increasing customer loyalty.

Advantages for Insurers

- Risk Assessment: Insurers can better understand the risk profiles of policyholders, resulting in more accurate pricing.

- Reduced Fraud: Analyzing data patterns helps identify and prevent fraudulent activities.

- Enhanced Decision-Making: Real-time data analysis aids in swift decision-making regarding claims and underwriting.

- Competitive Advantage: Offering personalized plans differentiates insurers in the crowded marketplace, attracting new customers.

By leveraging big data, health insurance companies can provide value-added services that resonate with customers’ needs and expectations.

3. Challenges in Implementing Big Data Solutions

Despite the clear benefits of utilizing big data in personalized health insurance plans, several challenges hinder its widespread adoption.

Data Privacy Concerns

- Regulatory Compliance: Insurers must navigate complex regulations surrounding data protection, such as HIPAA in the United States, which governs the use and sharing of medical information.

- Consumer Trust: Building trust with consumers is essential, as individuals are often concerned about how their personal health data will be used.

Integration of Disparate Data Sources

- Data Silos: Health data is often stored in disparate systems across various entities (e.g., hospitals, pharmacies), complicating data integration efforts.

- Interoperability Issues: Different formats and standards for data can lead to inefficiencies and inconsistencies in analysis.

Technology and Skills Gap

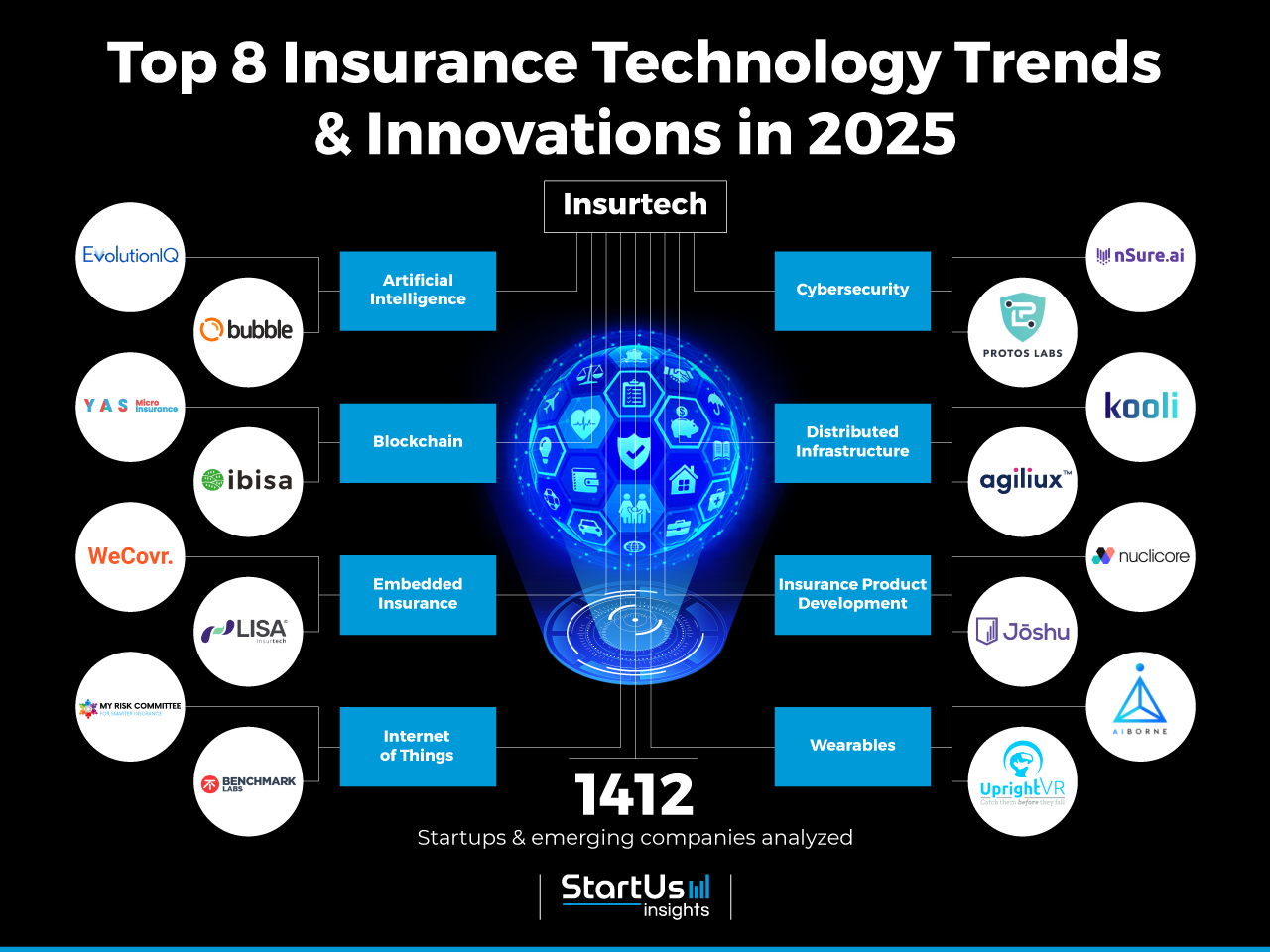

- Investment Needs: Implementing big data solutions requires significant financial investment in technology infrastructure and skilled personnel.

- Talent Shortage: The demand for data analysts and scientists outpaces supply, making it difficult for insurers to assemble capable teams.

Despite these challenges, proactive strategies and investments in technology can mitigate obstacles, allowing insurers to harness the power of big data effectively.

4. The Future of Big Data in Health Insurance

As technology continues to evolve, the role of big data in personalized health insurance plans will likely expand in the following ways:

Advanced Predictive Analytics

- Machine Learning Algorithms: These technologies will enhance insurers’ ability to predict health trends and consumer behavior, allowing for more personalized offerings.

- Real-Time Monitoring: Wearable devices and IoT sensors will enable continuous health monitoring, feeding valuable data back to insurers for timely interventions.

Increased Personalization

- Dynamic Pricing Models: As insurers gather more data, they can develop dynamic pricing models that adjust based on real-time risk assessments and health behaviors.

- Customized Wellness Programs: Insurers will offer personalized wellness programs and incentives, fostering healthier lifestyles among policyholders.

Collaboration and Partnership

- Healthcare Ecosystem Partnerships: Insurers may collaborate with healthcare providers, tech companies, and fitness organizations, creating a holistic approach to health management.

- Shared Data Initiatives: Establishing shared data platforms among stakeholders can enhance data quality and utility, benefiting the entire healthcare ecosystem.

The future of big data in personalized health insurance plans holds great promise, paving the way for improved health outcomes and more efficient insurance practices.

5. Case Studies of Big Data in Action

Examining successful implementations of big data in personalized health insurance provides valuable insights into its practical benefits.

Case Study 1: A Major Insurer’s Predictive Analytics Program

A leading health insurer launched a predictive analytics initiative that leveraged big data to identify high-risk patients. By analyzing historical claims data, social determinants of health, and lifestyle factors, the insurer was able to segment its customer base effectively. The result was the development of targeted health programs that reduced hospital readmissions by 20% within a year.

Case Study 2: Personalized Wellness Incentives

Another major health insurer utilized data from wearable fitness trackers to create personalized wellness incentives. By encouraging policyholders to share their activity data, the insurer offered premium discounts based on individual fitness achievements. This initiative resulted in a 30% increase in policyholder engagement in health and wellness programs, driving down claims and improving overall health metrics.

Case Study 3: Enhanced Fraud Detection

A prominent insurer implemented advanced algorithms to analyze claim submissions in real time, identifying patterns indicative of fraud. Through big data analytics, the company reduced fraudulent claims by 25%, saving millions of dollars annually while maintaining a fair and equitable claims process for honest policyholders.

These case studies illustrate the transformative impact of big data on personalized health insurance plans, highlighting the potential for improved outcomes and operational efficiencies.

FAQs

What is big data in health insurance?

Big data in health insurance refers to the extensive collection and analysis of diverse data types, including patient records, claims data, and demographic information, to inform personalized insurance plans and risk assessment.

How does big data improve personalized health insurance?

Big data enhances personalized health insurance by enabling insurers to analyze individual customer profiles, predict health trends, and tailor coverage options to better meet each person’s unique needs.

What are the challenges of using big data in health insurance?

Challenges include data privacy concerns, integration of disparate data sources, regulatory compliance, and the need for skilled personnel to analyze the data effectively.

What is the future of big data in personalized health insurance?

The future includes advancements in predictive analytics, increased personalization of insurance offerings, and greater collaboration among healthcare stakeholders, leading to improved health outcomes and cost efficiencies.

How can consumers benefit from personalized health insurance plans powered by big data?

Consumers benefit through tailored coverage options, cost efficiency, proactive health management, and improved overall customer experiences, contributing to better health outcomes.

Conclusion

The Role of Big Data in Personalized Health Insurance Plans is undeniably transformative, offering significant advantages to both insurers and consumers. While challenges remain, the future prospects of big data in this space are promising. By embracing data-driven solutions, health insurance companies can enhance their offerings, streamline operations, and ultimately contribute to healthier populations. As technology continues to advance, the potential for big data to revolutionize personalized health insurance is limited only by our willingness to innovate and adapt.